Money, money, money. The world revolves around money. We agree; money doesn't buy happiness, but wouldn't it be quite a relief to have an extra million dollars in your saving accounts? Many people are far away from that accomplishment; instead, they have a generous loan bill.

Saving or investing? That’s the question. People struggle with finding a balance between spending and keeping the money for emergencies. DealSunny conducted a survey about spending behaviour in India and one of the questions the survey recipients were asked was:

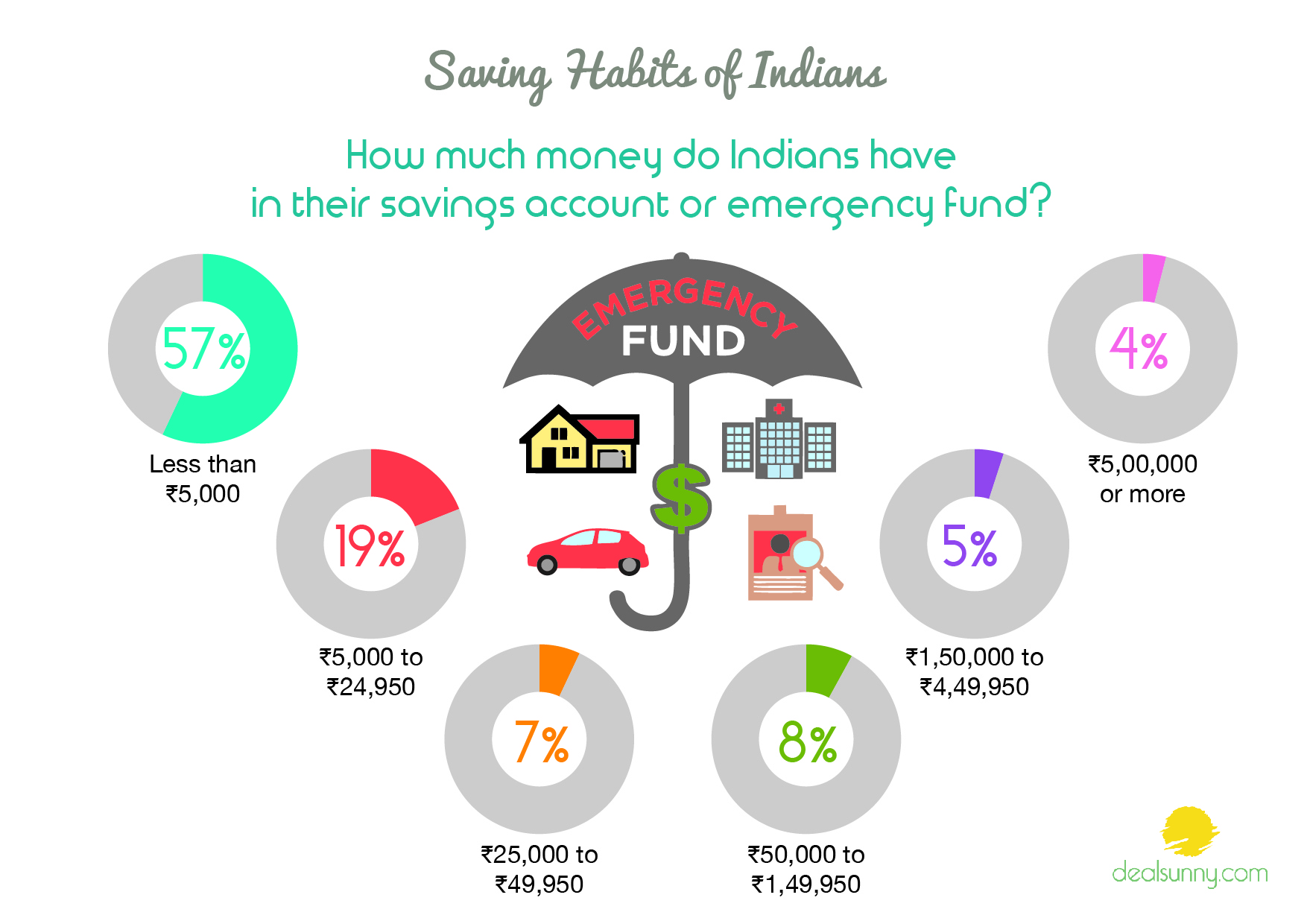

"How much money do you have in your savings account or emergency fund?"

We did extensive research, and after asking Indians from all over the country, it was found that almost 60% of them have less than ₹5,000 in their savings account or emergency fund. The survey revealed shocking results, here are some key findings:

- Only 2% of Indian males have more than ₹5,00,000 in their savings account while for females this percentage is 5%.

- 68% of Indians with more than ₹5,00,000 in their savings account or emergency fund live in the North or West of the country.

- 61% of Indians with more than ₹5,00,000 in their emergency fund have a Master's degree or higher.

- 86% of high school students and college students have less than ₹5,000. For Indians who work full-time, this is only 34%.

- 35% of married Indians have more than ₹50,000 in their saving accounts . Among singles, this is only 8% while for Indians who are in a relationship (but not married) this is 12%.

- The North of India has more relatively rich people than the other regions.

- Almost 90% of Indians who are younger than 18 have less than ₹25,000 in their emergency fund.

Nearly 3 out of 5 Indians have less than ₹5,000 in their savings account or emergency fund. Let's say that ₹5,000 is enough to purchase a nice outfit or a brand new mobile phone; but is it sufficient to secure one’s future? Should an account with that amount of money be called a "saving account" or even an "emergency fund"?

Poor planning, inflation, and low income could be the main reasons of the survey showing these impressive results. Also, there are more and more businesses inviting people to purchase products they don't really need, which makes saving a fantasy more than a reality.

Only 16% of Indians have saved more than ₹50,000, and this percentage is indirectly proportional to the amount of money they save. In other words, few people are saving enough money to cover any unplanned situation that risks their properties, health or even their lives.

DealSunny's research classifies the data, taking into consideration the population and some particular groups within it. Let's take a closer look at how this is reflected in some of the demographics.

Savings and Gender

Only 2% of Indian males have more than ₹5,00,000 in their savings account while for females this percentage is 5%.

There is a lot to take into consideration when analyzing these numbers. It is important to point out that there is a difference in the kind of jobs men and women have. More than the famous "gender pay gap", is the disparity of their payment they receive depending on their duties.

19.23% of Indian females have more than ₹50,000 in their savings account or emergency fund. For males, this percentage is 13.92%.

Surprisingly, it seems that men have less economic freedom than women do; it suggests that in a relationship, women are not likely to financially rely on their partners anymore.

Savings and Age

Only 2,5% of Millennials have saved more than ₹5,00,000.

More than half of Generation X respondents have more than ₹50,000 in their savings account or emergency fund. This is significantly higher than the national average of 16.41% or the average of all other age groups combined (11.53%). DealSunny's findings suggest that Indians who are 35 to 54 years old tend to save more than any other age group in the country.

For the youngest generation, those in the age between 18 and 34, it is not easy to put money aside. 80% of millennials have less than ₹25,000 in their savings account or emergency fund, and only 2,5% has more than ₹5,00,000. In addition, 75% of Indians that are below 18 years old, have less than ₹5,000 while almost 90% have below ₹25,000.

It is not a big surprise that young Indians are struggling with saving, at the end of the day they have been part of the workforce for few years and they are probably just getting started with their professional lives. On the other hand, those in Generation X have had enough time to earn money and save while they are still young enough to be productive.

Savings and Qualification

Highly educated Indians are more likely to save money.

Education can be underestimated due to its high cost. Tuition and fees often leave students with a degree but with a huge loan bill as well. Nonetheless, it seems like in India it pays off to go to college. DealSunny found that savings are directly proportional to higher qualification. Of the people in India who have more than ₹5,00,000 in their savings account, 61% has a Master's degree or higher.

For instance, 10% of Indians with a high school diploma have more than ₹50,000 in their savings account or emergency fund. For Indians with a bachelor's degree, this is 13%. The real difference is made with a Master's degree: 36%.

There are some exceptions: 3.45% of Indians with no qualification have more than ₹5,00,000 in their savings account, while one third of Indians with a Master's degree have less than ₹5,000.

Savings and Household Income

The amount in the savings account or emergency fund is directly correlated with household income.

Numbers suggest that the more Indians earn, the more they save. 42% of Indians with a household income of ₹15 Lakhs or more say they have more than ₹5,00,000 in their savings account. Also, of the Indians who have more than ₹5,00,000 in their savings account, 75% has a household income of at least ₹7,5 Lakhs.

For those who earn less, the story is a little bit different. 93% of Indians with a household income of less than ₹2 Lakhs have less than ₹5,000 in their saving accounts.

Savings and Relationships

Married Indians save more money.

On average, married Indians have more money in their savings account or emergency fund. 35% has more than ₹50,000. Among singles, this is only 8%. For Indians who are in a relationship but not married yet, this is 12%. Also, only 55% of married Indians have less than ₹25,000 in their savings account. This is almost 20% lower than the national average.

Dilemma: Saving, investing or spending?

The scene looks excellent for married and well-educated people who are between 35 and 54 years old and have a stable household income. Also, the research shows that those living in the North of the country tend to save more as well as Indians who have a full-time job.

But, what for the rest of the population? With a low household income, putting money aside can be tough. Sadly, those with less money in their bank account are more likely to have an economic emergency. This is when some of them decide to take action in order to change their situations, some of them move or even get married to economically support each other. There is always a solution to get out of debt and start saving money.

Remember: "It is better to have, and not need, than to need, and not have.”

This blog article covers only one of the questions we covered in our extensive survey. Check out the full Spending Behaviour in India Report to find out everything about the spending habits of Indians.